The US Federal estate tax, also known as the inheritance tax or the death tax, is a tax levied upon the total value of an individual’s estate upon their death. It is actually one half of the Unified Gift and Estate Tax system, the other half being the gift tax — a topic for a later article. The unified transfer tax system is designed to keep very wealthy individuals from transferring property tax-free to their heirs, preventing so-called “dynasty families” (think Rockefellers, Rothschilds, and Hiltons). Unfortunately, it sometimes has unintended effects on small family-run farms and businesses. The topic of estate taxes often becomes very politicized, and there are good arguments for and against it on both sides of the aisle — but as an advisor, our job is not to argue politics. We simply present the facts about current and/or proposed law and help our clients plan accordingly.

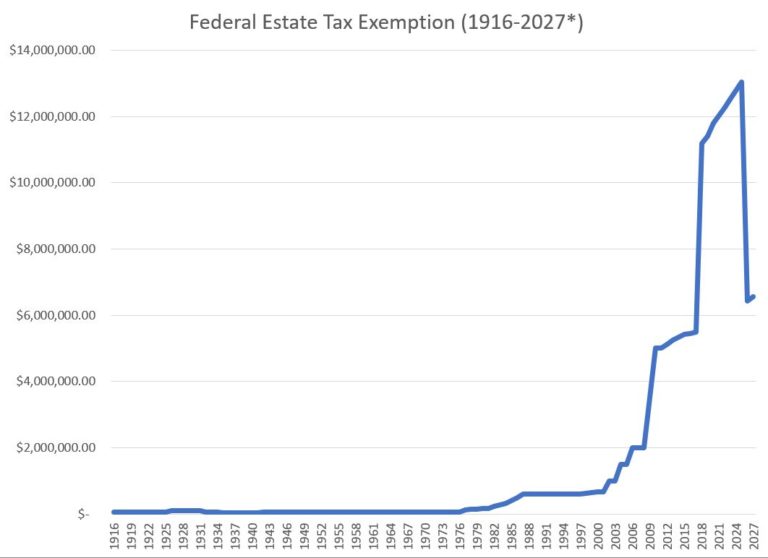

The most important thing to understand about estate taxes (and about transfer taxes more broadly) is the unified lifetime exemption amount. This amount, which has varied greatly over the past ten years, is essentially the amount that an individual may transfer to other individuals and heirs without incurring a transfer tax. The exemption may be used during a person’s lifetime to gift property to family members and any remaining exemption may be used to offset any estate tax at death when other property transfers. From 2011 to 2017, this amount was $5 million adjusted for inflation each year (that’s $5 million per spouse). With the passage of the Tax Cuts and Jobs Act (TCJA), the exemption was increased to over $11 million per spouse.

However, we know for a fact (barring an extension by Congress) that the tax law changes for individuals attributed to the TCJA are set to expire in tax year 2026. This includes the individual tax rates, changes in individual tax deductions, and yes, the lifetime estate and gift tax exemption. This means that in 2026 the annual exemption will come down to somewhere between $6 million and $7 million, depending on how high inflation is between now and then. On top of that, Joe Biden has already made clear that he plans on repealing the TCJA almost immediately if he is elected in November — so we may see a return to the old exemption amount sooner rather than later (at the time of writing this we are about four months away from the election).

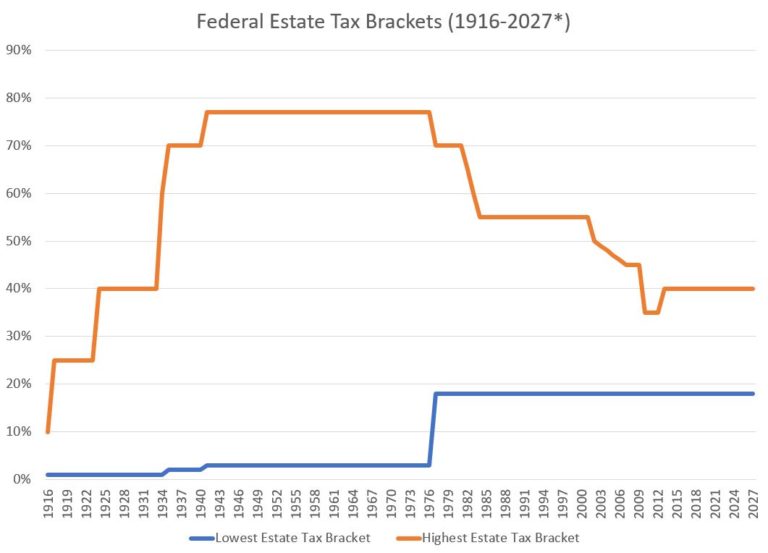

Okay, I’ve beat that lifetime exclusion horse to death, now we need to talk about what happens if your estate is worth more than the exclusion. First, if you’re married, you can transfer an unlimited amount to your spouse tax-free. Also, if you don’t use all of your lifetime exclusion, the remainder can be passed to your spouse. If you’re charitably inclined, you can leave an unlimited amount to charity completely tax-free. However, if your estate is still over the threshold after subtracting those deductions, then any amount greater than the exemption will be subject to a tax rate of 40%. If you think that’s high, then you might be surprised to find out that that’s around the historical average. In fact, the highest estate tax rate in history was 77%, from 1941 to 1976.

Months ago, at a financial advisor conference in Topeka, KS, I had the pleasure of listening to Ed Slott, also known as “America’s CPA”. He pointed out that right now is one of the best times in history to die. He recommended that if you have any wealthy in-laws that might be at risk of passing away after 2026, then you may want to give a certain insurance company a call, Mutual of Brooklyn (MOB). *The crowd erupts with laughter.* Okay, the joke was better in person, but you get the idea.

All joking aside, if you are even close to the lifetime exemption, I recommend you seek advice from a qualified financial advisor, attorney, or CPA about your situation. If you are a farmer or a business owner there is a good chance that your estate is worth more than you think. There are many planning techniques that can reduce your taxable estate, but almost all of them require planning ahead of time.

This article is meant to cover only federal estate taxes. Many states have their own estate or inheritance taxes, including Illinois. If you are an Illinois resident, I highly recommend reading our next article on Illinois estate taxes.